WELCOME TO MR. FINANCIALISTs HOME

Financial Guidance for Learn, Invest & Grow

Helping people to become aware about investing their savings in right way and at right time is essential for long term financial security. Many people work hard to earn money, but yet fail to grow effectively due to lack of financial awareness, poor guidance or fear of making the wrong decisions. This platform is dedicated fulfill that gap through clear, reliable and expert driven financial insights.

Deepak Baitha

Blog Author

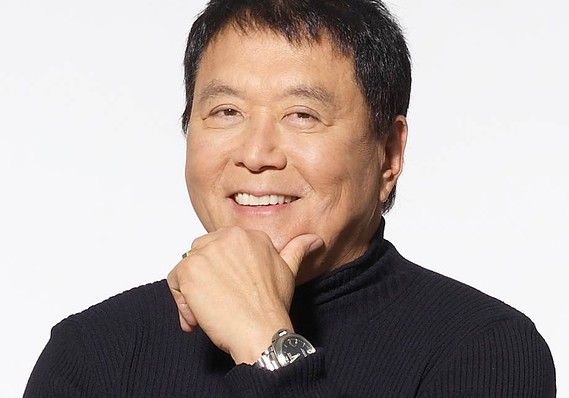

“Don’t work for money-make money work for you.”

– Rober Kiyosaki

Instead of always working to earn more money, you put your money into things like investments or assets that earn more money over time. That way, your money starts earning for you.

When you invest your money in the right places, it can start growing on its own. For example, your investments might pay you interest, dividends, or rental income, or they may increase in value over time. The important part is that this growth happens even when you’re not actively working for it every day.

Trending Topics

Gold prices have reached record highs in 2026. Many investors are buying gold because it is seen as a safe option during global uncertainty. Economic concerns, inflation, and market instability have increased demand, pushing gold prices above previous historical levels.

Why Gold Prices Are Rising Today

Why You Should Invest in Mutual Funds

Why People Invest in Property

Best Investment Options

A good investment plan uses different options instead of putting all money in one place. Mutual funds and stocks help your money grow over time. Gold gives safety when markets are uncertain. Real estate builds long-term value and can give rent income. Fixed deposits and government bonds are safer but give lower returns. Investing in your skills or a small business can increase your income the most. When you mix safe and growth investments, your risk becomes lower and your money can grow more steadily. This balanced method is better for long-term wealth building.

- Mutual funds (SIP)

- Fixed Deposits (FDs)

- Stock Market (Shares)

- Gold (ETF or Digital)

- Real Estate (Land)

- Government Bonds/Schemes

What Experts Say

“For long-term investing, stay patient and think in years, not months. Invest regularly and don’t panic when markets fall. Keep your money in good assets for a long time so it can grow through compounding. Review your plan yearly, not daily. Discipline and consistency matter more than quick profits.”

Warren Buffett

“Buy investments with a safety margin — never pay too much. Focus on value, not market hype. Treat investing like buying a business, not trading a stock. Stay disciplined, research well, and avoid emotional decisions. Be patient and protect your capital first; profits come later with time.”

Benjamin Graham

“Focus on buying assets, not liabilities. Assets put money in your pocket, liabilities take money out. Start small but start early. Learn how money works, take smart risks, and don’t depend only on one income source. Build multiple income streams for long-term financial freedom.”